Incentives

This page lists opportunities for support improving farm energy efficiency. This includes no-cost, no-commitment technical assistance, equipment and facility rebates, and grants to share the costs of energy efficiency upgrades or installations. Extension staff are happy to help you navigate these options at any point in the process of improving your farm’s energy efficiency.

Read about opportunities below and contact us for assistance. Get started with an energy assessment, or subscribe for program updates and announcements, by completing an interest form.

Eligibility

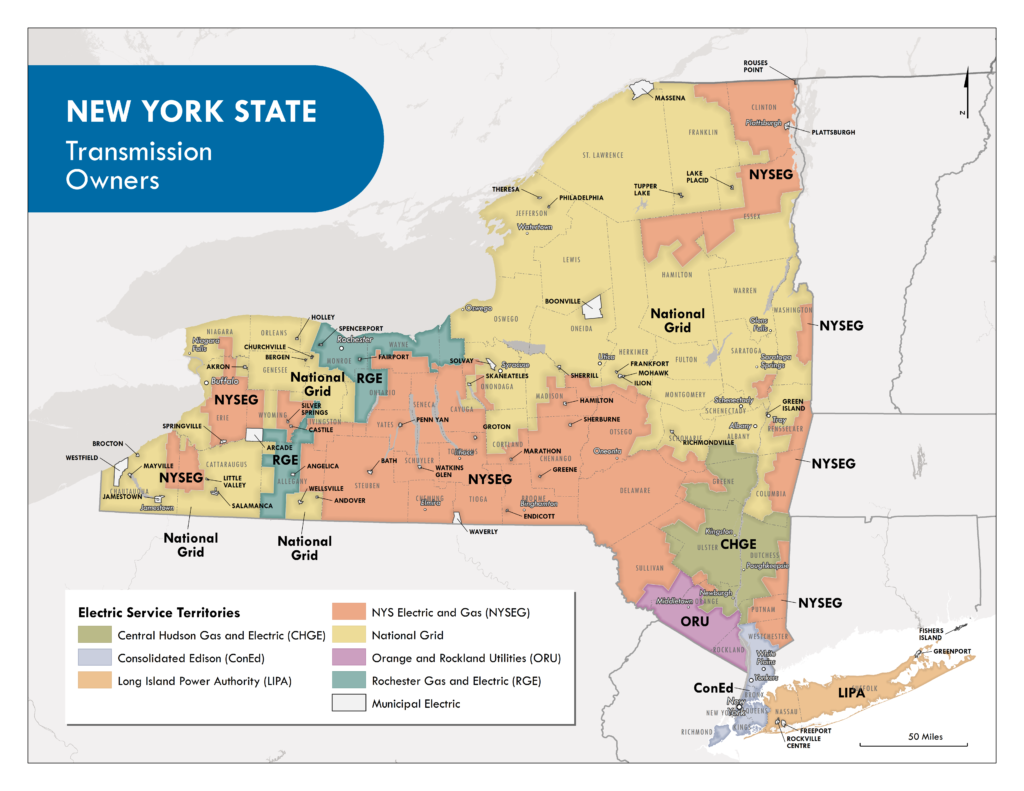

Your eligibility for certain technical support, rebates, and grants will depend on your electric utility provider, based on where you are. The New York Transmission Owners Map below, provided by NYSERDA, is one way to check who your electric utility service is. You can confirm your utility provider by reviewing your utility bill or using the NYS Electric Utility Service Territories Map.

For NYSERDA funding and support, eligibility is based on the System Benefits Charge (SBC) which most electric utility customers in New York pay. To determine if you are paying the SBC, look at a recent bill from your utility company to see if “SBC” or “RPS” is listed as a charge. Even if you do not pay the SBC, you may be eligible for support through other farm energy efficiency programs and incentives.

Financial support for energy efficiency improvements sometimes requires a farm energy audit first. NYSERDA offers no-cost, no-commitment farm energy audits for utility customers paying the SBC, and NRCS EQIP also offers farm energy audits in the form of an Agricultural Energy Management Plan.

Financial support for energy efficiency improvements sometimes requires a farm energy audit first. NYSERDA offers no-cost, no-commitment farm energy audits for utility customers paying the SBC, and NRCS EQIP also offers farm energy audits in the form of an Agricultural Energy Management Plan.

No-cost energy assessments are available to most New York utility customers from the NYSERDA Agriculture Energy Audit Program to help farmers understand their energy needs and cost-saving opportunities. Eligible farms are connected with a FlexTech Program Consultant in collaboration with NYSERDA, who can evaluate energy use for an entire farm or for a specific system on the farm depending on farmer interests. The technical assistance and energy analysis report from the FlexTech Advisor will show what cost-saving energy efficiency improvements are relevant and highest-priority.

There is no commitment for farmers who participate in energy assessments. This program is intended to connect farmers with technical experts and freely provide more information, to help farms in New York be more economically and environmentally sustainable.

To start the process of getting a no-cost, no-commitment energy assessment of your farm, please complete the Ag Energy NY interest form. Cornell Cooperative Extension staff will serve as a coordinator for your energy audit and any follow-up steps you choose to take to improve energy efficiency on your farm.

Technical assistance at no cost to farmers

Rebates and Credits

Rebates allow farmers to reduce upfront costs of energy efficiency upgrades. Energy utilities in New York State offer cost-share or rate-reductions for their customers investing in energy efficiency. These programs are updated on an annual basis. Here are programs to be aware of:

- National Grid offers discounts and rebates for installations of energy efficient agricultural equipment, through their Agri-business Program.

- New York State Electric and Gas (NYSEG) and Rochester Gas and Electric (RG&E) offer rebates on agricultural equipment through their Commercial and Industrial Rebate Program. More information, including examples of qualifying upgrades and an equipment rebate catalog, are available on the NYSEG and RG&E websites. Note that there are prescriptive rebates which do not require pre-approval before construction, as well as custom rebates which work on a pay-for-performance basis and do require pre-approval before construction.

- Both National Grid and NYSEG/RG&E agricultural customers may be eligible for discounts on their residential electricity bill. See the National Grid Residential Agricultural Discount Program or the NYSEG/RG&E Residential Agricultural Discount Program.

Tax credits can also offset the costs of energy efficiency upgrades. For more information, see the ENERGY STAR page on Federal Income Tax Credits and Incentives for Energy Efficiency. The IRS also offers a factsheet on frequently asked questions about energy efficient home improvements and residential clean energy property credits.

Energy efficiency can be a big investment. Strategic improvements will have up-front costs that are eventually paid back by energy cost-savings, while providing long-term benefits. Sign up for a free energy assessment to get expert guidance on what upgrades and grants are best fit for your farm. Here are some grants that your farm might be eligible for:

Energy utilities in New York State offer grant programs for their customers. These programs are updated on an annual basis. Here are programs to be aware of:

- National Grid has grants available for capital improvements related to Agriculture Agribusiness Productivity, 3-Phase Power, Renewable Energy, Power Quality Enhancement, and more. More information is available at www.ShovelReady.com.

- NYSEG and RG&E offer incentives for electric-related infrastructure improvements on farms, including facility and equipment upgrades, three phase power, and other opportunities. More information is available at www.lookupstateny.com/economicdevelopmentprograms/additionalprograms/agriculture-capital-investment-incentive-program.

The following grants and financial assistance apply to broader areas and topics than only New York State and farm energy efficiency. These can help cover large up-front costs to make energy conservation more accessible for farmers. This information, and more, is summarized by Farm Credit East in their “Grant Funding for Northeast Agriculture” presentation and report (2018).

- On-Farm Energy Initiative – part of the Natural Resources Conservation Service (NRCS) Environmental Quality Incentives Program (EQIP) – provides eligible farmers with technical and financial assistance for farm energy efficiency improvements. NRCS practice code 374 is for the “development and implementation of improvements to reduce, or improve the energy efficiency of on-farm energy use.”

- Rural Energy for America Program (REAP) grants and loan-guarantees from USDA: helps eligible farmers and rural small businesses to implement energy efficiency and renewable energy projects. Grants up to 25% of project costs or guarantees up to 75% of loan project costs, with a maximum of $250,000 for energy efficiency and $500,000 for renewable energy. (With the Inflation Reduction Act of 2022, grants will be able to cover up to 50% of project costs.)

- REAP Technical Assistance Program (RTAP) provides no-cost assistance to New York Agricultural Producers with applying for USDA REAP grant and loan programs. Assistance includes the preparation of a technical report in accordance with REAP guidelines, help in filing various registrations necessary for applying for REAP, assistance in completing environmental reports and other documentation required with a REAP application, and more.

- NY Farm Service Agency (FSA) Farm Storage Facility Loan Program provides low-interest financing to upgrade storage and handling facilities for farm products such as fruits and vegetables, maple sap, eggs and more.

- Carbon Neutral Community Economic Development Program from NYSERDA awards grants “to support economic development projects across New York State for projects that are regionally significant and designed to carbon neutral net zero energy performance.” That has included substantial on-farm construction projects as part of the Carbon Neutral Facilities category.

- NY Farm Viability Institute Grant offers $15,000 to $125,000 for projects working with NYS resident farmers to clarify the economic impact of best practices for food system resilience, climate change adaptation, and other topics related to energy efficiency.

- Climate Resilient Farming Program and other NY Agriculture funding opportunities.

- NY-Sun – a program by NYSERDA – offers solar incentives and support for residential and commercial installations. The process requires you go through a qualified installer. Depending on the scale, farms could be considered small commercial or regular commercial/industrial. For questions regarding solar installations in agricultural districts, you can contact cleanenergyhelp@nyserda.ny.gov.